free cash flow yield explained

Get 3 cash flow strategies to stop leaking overpaying and wasting your money. T left its outlook mostly unchanged though it did reduce its free cash flow guidance from 16 billion to 14 billion.

Fcf Yield Unlevered Vs Levered Formula And Calculator

The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

. Heres the fun part. Net Free Cash Flow Yield. Learn What EY Can Do For Your Corporate Finance Strategy.

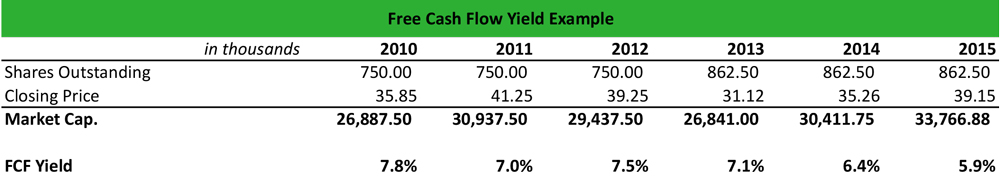

You can calculate your companys free cash flow yield by dividing its free cash flow per share by the current share price. The free cash flow yield gives investors an idea. The free cash flow yield FCFY is a financial solvency metric that compares a companys predicted free cash flow per share to its market value per share.

Net Free Cash Flow makes further allowances for the current portion 1 year of long term. Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More. Free cash flow yield is the financial solvency ratio of a company.

Key Takeaways A higher free cash flow yield is ideal because it means a company has enough cash flow to satisfy all of its obligations. If the company has 200 in free cash flow last year the cash yield is 200 divided by 10000 or 20 per 1000 share. Explain Free Cash Flow and Free Cash Flow Yield Free Cash Flow Calculation.

Ad Our Business Experts Provide An In-Depth Analysis To Uncover Business Opportunity. Ad 93 of small business owners are constantly leaking money on useless and unnoticed things. That shortfall was explained as being mainly due to increased.

Free cash flow yield is a financial ratio that measures how much cash flow the company has in case of its liquidation or other obligations by comparing the free cash flow per. If the free cash flow yield is low it means investors arent receiving a very good return on the money theyre. And free cash flow can be distributed in the form of.

Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. How to convert free cash flow to firm. Thats 2 the same as the bond.

Operating cash flow is important because it reports the amount of cash from operations. As an analytical tool free cash flow FCF is valuable for determining a companys operating potential. Ad EY Has the People Analytics and Tools to Help You Better Allocate Capital.

The ratio is computed by dividing free cash flow per share by the current share price. Free Cash Flow Yield is a metric that measures how much free cash flow the company generated for investors relative to the price that investors have to pay to buy their stake. Our Business Consultants Will Partner With You To Build Financial and Operational Success.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Meaning Examples What Is Fcf In Valuation

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Formula Top Example Fcfy Calculation

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Yield Fcfy Formula Examples Calculation Youtube

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fcf Yield Unlevered Vs Levered Formula And Calculator

Terry Smith Free Cash Flow Yield Explained Youtube

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Conversion Fcf Formula And Example Analysis

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)